Why Traditional Approaches Generate Lower

Risk-Adjusted Returns

It’s not about stock picking or manager skill — it’s about structural market challenges that reduce returns for passive investors. EPIG is designed to neutralize these four fundamental constraints.

P/E Dependence

Future returns depend on entry P/E:

High starting P/E = Lower 10-year returns

Correlation Challenge

Most stocks move with the market:

Diversification ≠ Protection

Still suffer full market drawdowns

Diluted returns from winners

Full Exposure Required

Must invest 100% to get average returns:

No liquidity for opportunities

No control over downside

Cannot leverage selectively

Lost Decades

Cannot generate returns in down/sideways markets:

Example: 2000–2010

10 years of capital locked up, zero growth

Introducing the EPIG Investment Strategy

EPIG Defined: Enduring Principal-Protected Income & Growth

Our proprietary investment approach designed to maximize returns while protecting capital during market downturns. EPIG functions as a complete solution or a “bolt-on” to existing portfolios.

EPIG Key Benefits

Beats Market Longer Term

Absolute returns >10% with lower volatility

Drawdown Protection

Shields portfolios from major market corrections

Cash-Like Liquidity

Access to funds when you need them

Income Potential

Generate yields up to 1% per month

Investment Chassis

Complete solution or bolt-on to existing portfolios

P/E Ratio Independence

Returns not dependent on market entry timing

Dynamic Positioning

Adjust exposure based on market conditions—not dependent on entry P/E

Tactical Entries

Enter only high-probability setups—uncorrelated to broad market moves

Liquidity + Control

Stay 50–90% in cash/SPY—full liquidity to leverage opportunities

Market Neutral

Generate returns in up, down, and sideways markets—no lost decades

Result: Consistent ~20% CAGR target regardless of structural market challenges

The Power to Consolidate: Housing 50–90% of Your Liquid Net Worth

Why EPIG’s Architecture Enables What Traditional Approaches Cannot

The EPIG Consolidation Capability

<10% Max Drawdown

Engineered by design — not luck. You’re always in control because risk is capped systematically.

Daily Liquidity

Access your capital whenever needed. No lockup periods, no penalties — full flexibility.

100% Transparency

No black box. Every trade, every position, every decision is visible and explainable.

Systematic Edge

Not discretionary gambling — repeatable, rules-based strategy with defined risk parameters.

The Result: Unlike traditional strategies that force you to spread assets across multiple “buckets,” EPIG’s architecture lets you consolidate 50–90% of your liquid net worth into a single unified strategy — because you’re in control at all times.

Antifragile by Design (Taleb): Convexity in Volatility

EPIG is inspired by a barbell logic: a defensive base plus small convex bets designed to benefit from volatility.

Worse when volatility rises.

Resists shocks; doesn’t improve.

Can improve as volatility rises (convexity).

Defensive base reduces fragility (selective exposure).

Convex sleeves seek asymmetry in turbulence.

Circuit breakers cap downside; optionality preserves upside.

What this is NOT: This does not mean risk-free or always profitable — convexity can have carry costs.

Educational concept only. Results vary; losses can occur.

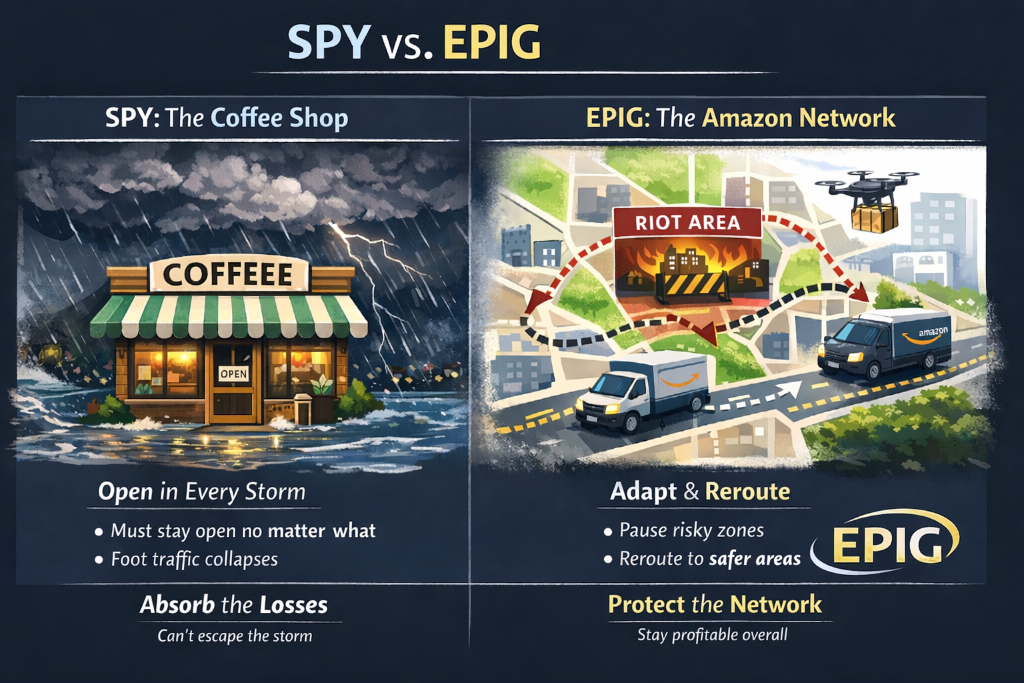

SPY vs. EPIG

Passive index investing locks you into every storm. EPIG adapts, reroutes, and protects the network.

Traditional buy-and-hold S&P 500 has significant limitations:

Traditional Approach

Always in the market – full exposure to all market phases

Full drawdowns during corrections (30–50%+)

No cash cushion to deploy during opportunities

Returns dependent on P/E at entry (timing risk)

Selective Exposure Strategy

~90% of principal fully secured always

3–5% tactical overlay + 3–5% long-term – precisely controlled exposure

Selectivity = constant exposure – quality over quantity

Circuit breakers & auto-shutdown protections built in

Key Insight: By harvesting only high-EV windows (and otherwise sitting in bills), the design aims to compound at ~20% CAGR over a 2–3+ year horizon while avoiding major drawdowns. The edge is not in any single trade — it’s in the system-level compounding over hundreds of trades.

Market Exposure Comparison:

The Three-Layer Design

Each layer serves a distinct structural purpose. Together they create an investment system that protects, generates income, and compounds.

Core Allocation

Structural equity base providing market participation with downside awareness. SPY-anchored with an optional stock sleeve.

Tactical

Defined-risk futures trades overlaid on the core. Systematic entries with 20-point stops generating repeatable income.

Episodic Pivot

Asymmetric options capturing outsized moves during market dislocations. Limited risk, unlimited upside potential.

Return Contribution by Strategy

Target annual return breakdown across the three layers — compounding goal: ~20% CAGR over 2–3+ years

Portfolio Allocation

How capital is distributed across the three layers

~80% of capital remains protected in broad market exposure (Strategy A), while a small 3–5% tactical overlay (Strategy B) generates outsized returns through systematic, defined-risk futures trades. Strategy C adds asymmetric upside from episodic opportunities. The goal: ~20% CAGR sustained over 2–3+ years through disciplined compounding with structurally limited downside.

Project Your Year-End Returns

LiveSee how YTD performance across all three strategies could compound through year-end. Powered by real 2026 trade data from verified IB fills — adjust portfolio size and explore per-strategy breakdowns.

Loading live trade data...

Open Performance Projector*Based on YTD performance extrapolated to full year. Past performance is not indicative of future results.